Paid in full

As we move into the depths of winter, energy costs remain close to the top of the political agenda. But one vulnerable group – the 4 million UK households who pay for energy via pre-payment meters (PPMs) – remains overlooked in the national debate. High prices and the concentration of energy use in the winter months means that, on average, households with a PPM will need to spend more than 30 per cent of their income on energy costs during the winter months. As PPMs are concentrated among poorer families, this drain on family finances is unsustainable, leading to families sitting in cold, dark homes. Further, more than half of PPM households are in debt to their energy suppliers, and as these debt costs are recouped when meters are topped up, leaving less credit available for much-needed energy. Finally, PPM customers remain overlooked when it comes to the Government’s decarbonisation plans, raising questions on the extent to which they will be able to reap the rewards of cheaper energy that the net zero transition is expected to deliver.

The debate around winter energy costs continues to overlook those who pre-pay for their energy

As Britain moves into deepest darkest winter, the debate around energy costs remains high on the political agenda. Energy bills remain well above their pre-crisis levels – typical bills are set to be more than £1,700 in Q1 2025 compared with just under £1,300 in late 2021 – and the position of some pensioners has deteriorated following the Government’s announcement to means test Winter Fuel Payments. But with this decision continuing to shape the news agenda – especially as the Scottish Government is forging a different path to the rest of the UK – there is little space for other vulnerable groups to have their voices heard.

In that context we should spare a thought for the 4 million households in the UK that are on pre-payment meters (PPMs), and so pay for their energy at the time of consumption rather than spreading costs accrued in periods of high consumption over the year (as direct debit or standard-credit customers do). Those on PPMs are heavily concentrated towards the bottom of the income distribution – a quarter of the poorest fifth of English households pre-pay for energy, compared with 1.5 per cent of the richest fifth – and in social and private renting households, where 38 and 18 per cent of families, respectively, are on PPMs, compared to just 2 per cent of owner occupiers.[1] Further, PPM customers don’t have relief from being in less energy-hungry homes: there is an equal share in those with high efficiency as those with low – around 10 per cent across all EPC bands.

Successive governments have acknowledged the vulnerabilities of PPM customers. During the 2022 energy crisis, price cap rates for PPM customers were reduced and ‘forced installations’ of PPMs were halted (typically these were made where a household had fallen behind on their energy bills). More recently, Ofgem has begun consulting on proposals to further equalise charges between households with different payment regimes, and to “raise debt standards” such that fewer customers are shunted onto PPMs when they fall behind on their bills (as well as writing off some debt accrued during recent years). But these actions fall short of proper protection for the section of society most exposed to high energy costs, who are already battling through another winter of real struggle.

PPM customers face a huge amount of volatility in energy spending

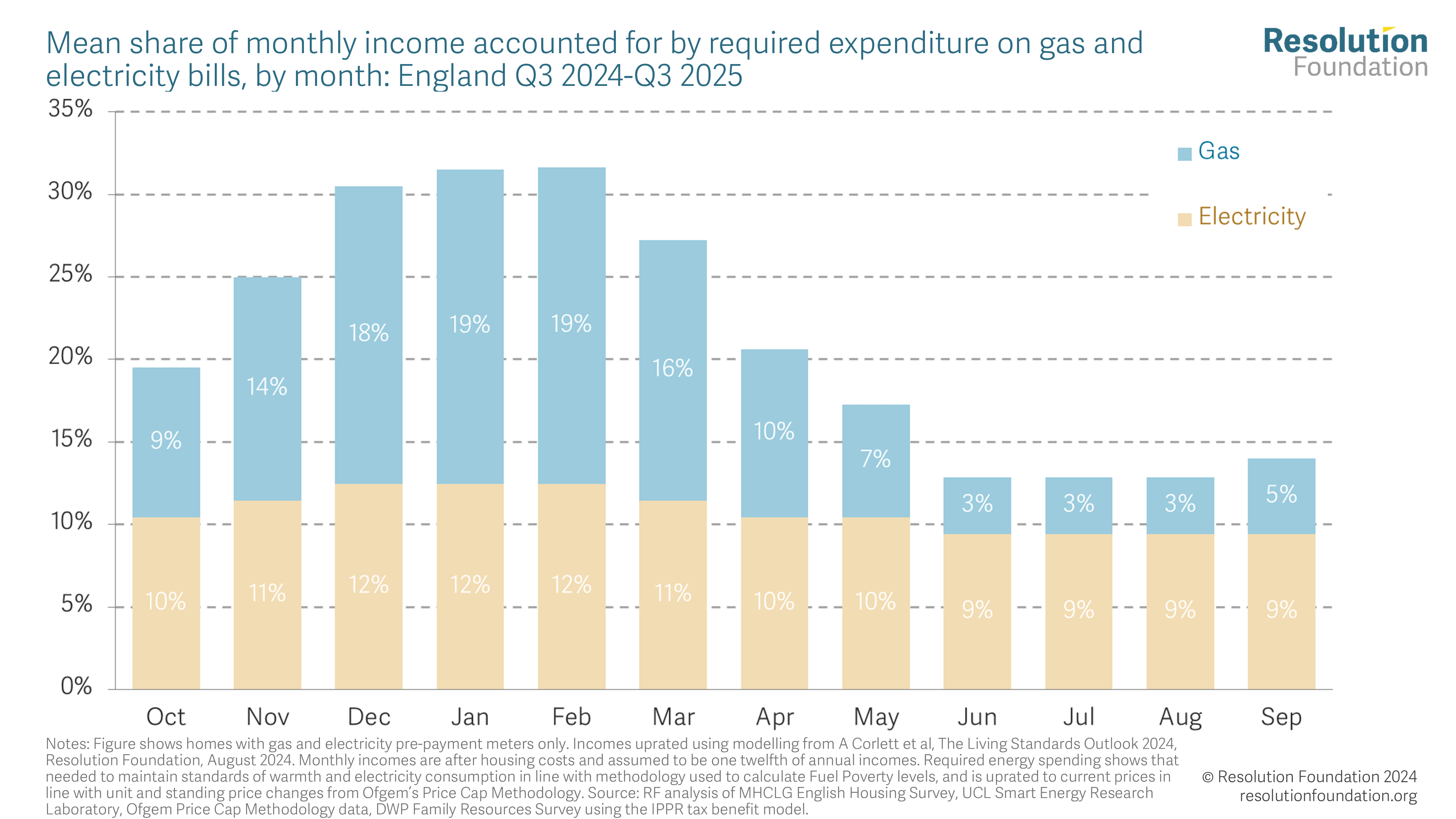

It’s hard to overstate the seasonal impacts of energy costs on the living standards of PPM customers. Spending – particularly on heating – is highly concentrated during the coldest time of the year, with 78 per cent of heating demand occurring between October and March, and 46 per cent in the first quarter of the year alone. This seasonal spike forces families to either spend a very high proportion of their income to keep warm, or to endure cold living conditions that bring with them significant health impacts. As Figure 1 shows, the amount of energy that PPM customers need to consume to maintain a reasonable standard of warmth and electricity use will – on average – be more than 30 per cent of their incomes during December, January and February – a figure that falls by close to two-thirds (to around 12 per cent) during the summer.

Figure 1 Pre-payment meter customers will need to spend nearly a third of income on energy during the winter months

This unsustainable drain on family finances explains why self-disconnections (i.e. running out of credit) are most concentrated in the winter months. In Q1 2023, 700,000 gas PPM customers self-disconnected at least once – the highest figure on record – with each disconnecting an average of four times during the three-month period. Self-disconnection is not only a route to feeling cold and being unable to wash or shower, but is also linked to emotional impacts such as financial stress – especially when caused by a wait for benefits payments – and feeling shame or embarrassment.

More than half of PPM customers are in debt to their supplier

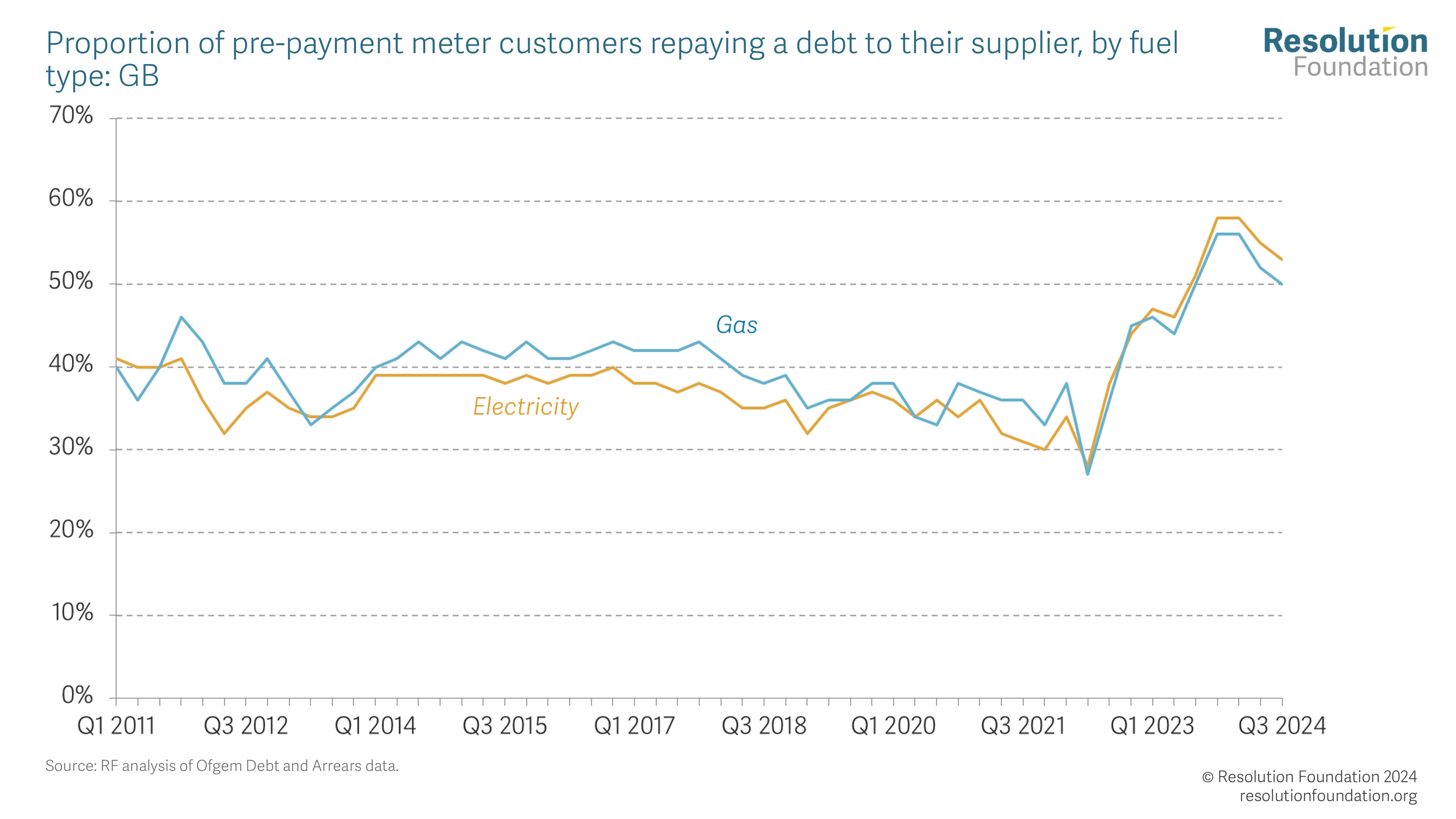

But even when PPM customers are disconnected from the grid, bills continue to rack up. Standing charges accrue regardless of energy use, and if there is no money on the meter to pay for them then they quickly turn into arrears. This frequently adds to already-existing debts (which is often the reason households are moved onto PPMs in the first place). Indeed, Figure 2 shows that the proportion of PPM households in debt to their suppliers increased by nearly half during the energy crisis. And although numbers have fallen back slightly from their mid-2023 peak, more than half of PPM customers remain in the red.

Figure 2 The number of PPM customers repaying energy debt shot up during the energy crisis

Debt is another part of the system which gives PPM customers a raw deal. Direct debit or standard credit customers usually see debts added to their monthly energy bills, but those who pre-pay for energy often see their debts jump to the front of the queue, meaning that the debts are taken from credit balances as soon as people top up. As such, it becomes much more likely that these families will run out of credit, and therefore start accruing debts again – a vicious circle that those who pay by other means can largely avoid.

Decarbonising PPM households is a challenge that policy makers are yet to face up to

Vulnerabilities among those who pre-pay for energy is not a new phenomenon, but the energy system – and the way that households engage with it – is undergoing a near-total overhaul as part of the UK’s plans to reduce emissions to net zero. For consumers, this boils down to two major changes: the consolidation of multiple forms of energy consumption to just one (electricity); and changing behavioural practices driven by increased exposure to price signals, and to new technologies (such as heat pumps) that offer best value for money when running for long periods of time.

Electrification brings with it an increased risk for PPM customers who battle with disconnections. At the moment, if the gas meter runs empty there is still electricity to allow families to keep the lights on and boil a kettle. But, when heating and cooking are electrified too, the stakes increase substantially. There has been little thinking on how to manage this concentration of risk in a way that does not leave PPM customers locked into gas heating for longer than those who pay bills differently.

There is also very limited understanding of how PPM customers will fare in a world of time-of-use tariffs, where off-peak electricity is cheap but that used when demand is high, or when supply is low, is priced at a premium. Currently, higher prices for time-of-use tariff customers are more common in the winter months (when PPM vulnerability is at its highest, as Figure 1 showed) and there is limited understanding of the ability of different household types to ‘shift’ their energy demand to ‘off peak’ hours. This brings with it a risk of PPM households being exposed to high prices at the time of the year when most energy consumption happens and outlay on energy is at its highest.

Another issue is that PPM customers often turn on their heating for short periods of time, or (for electric resistance heating) only in some rooms, as a way of better managing credit levels. But heat pumps (which are expected to provide most home heating in a low carbon future) are inefficient when used in this way and therefore can cost more to run. Although PPM customers are not likely to feature prominently in the early rollout of heat pumps, these issues will need addressing to avoid them being the last consumers left connected to the gas grid. These are tricky subjects that we will examine in more detail in 2025.

So, while energy bills continue to dominate headlines, we need to spare a thought for vulnerable PPM customers who are set to face unsustainable pressures on budgets this winter and continuing struggles with high levels of debt. Looking ahead, more attention will need to be paid to how this group fares amid the race to net zero.

[1] Source: RF analysis of HMCLG English Housing Survey data.