Resilient rust belts, cash conspiracies and dumping on the Dutch

Afternoon all,

A classic week on the economics/politics front – another numpty MP means another by-election’s on the way and the economy managed to actually shrink in October. The latter’s got the over-excited saying we’re recession bound – I’ve no idea if that’s right (note today’s PMI survey shows firms perking up a little, consistent with recent consumer confidence numbers). Obviously, it matters politically, but there’s no difference between the economy flatlining or marginally shrinking. What does matter is our inability to get this economy growing consistently – over the past 18 months we’ve managed just 0.5 per cent growth, the weakest performance on record outside recessions. It’s the substance not the label that counts people.

This is our last ‘normal’ TOTCs of 2023 – we’ve got a Christmas quiz next week where you can win (drumroll) your very own hard copy of Ending Stagnation, and on 29th we’ll look ahead to what 2024 has in store for our living standards.

Have a great weekend.

Torsten

Chief Executive

Resolution Foundation

Rusty regions. It’s old news that deindustrialisation has been very bad news on average for manufacturing focused cities. But a new paper is worth your time for its focus on the variation in how such cities have done (and Bruce Springsteen epigraph). Looking across 1,993 French, German, British, Italian, Japanese and American cities it has two important findings. First, the variation is large, with some previously manufacturing dependent cities successfully navigating deindustrialisation (a third of manufacturing hubs had recovered or exceeded their relative employment levels by 2010). The authors focus on the role of human capital in determining which cities did/didn’t manage this transition well – each percentage point increase in the graduate share of workers pre-deindustrialisation was associated with a 2.95 percentage point higher employment growth per decade afterwards. The cross-country patterns are also interesting: it’s no surprise Germany has had the most resilient rust-belt cities, but how far America lags behind the pack hugely stands out: its manufacturing hubs are half as likely to have recovered as their UK/French/Japanese peers. There’s a reason The Boss is American.

Cash conspiracies. The tragedy in the Middle East has been accompanied by a proliferation of misinformation and conspiracies online. The world of markets hasn’t been immune, as a pretty jaw-dropping FT Alphaville blog explains. It debunks a paper that alleged major short-selling of Israeli stocks before the October 7th attack (implying prior knowledge of Hamas’s plans). The paper was covered by major newspapers and the BBC, but it turns out the authors got their shekels and agorot (100 agorot equals a shekel) confused leading them to overstate the profit on short-selling by *a hundred* times ($800, rather than $8, million). As ever, read with care.

Pronunciation problems. Does how difficult your name is to pronounce affect labour market outcomes? Recent research finds a significant effect – job applicants with “less fluent” names experience lower callback rates – even looking within ethnic groups. Another argument for name blind job-applications, with names an important trigger of a range of biases. On the more positive side, until that happens I’ll be blaming my dodgy foreign name for all rejections.

Pondering PISA. The Ending Stagnation special last week meant we didn’t cover the PISA results (cross OECD test results for 15 year olds in English, Maths and Science), but they are worth a read (for a short, government friendly, summary here’s Jonathan Simons’ blog). The debate in England has focused on the relative improvement in performance over the past decade and a half – relative to the OECD as a whole and to the other home nations. Something well worth celebrating (and considering in policy circles in Scotland and Wales). There is also good news on the equity front – including the astounding result that 2nd generation immigrants actually do significantly better than average in the UK (see page 350). Globally though attention has more focused on the fact that results across much of the advanced world have been getting worse over the past decade (England’s improved ranking largely reflects everyone else getting worse). It’s the phones isn’t it?

Cyclical consumption. People who get richer spend more. You knew that. It’s true for income but also wealth – when house prices rise, homeowners splurge. But how strong is this wealth effect? An IMF deep dive examines 20 European countries between 1980-2023, analysing housing wealth and consumer spending patterns. Consumption does increase quickly when house prices rise (another reason to ignore those who say asset valuation changes have no real world impacts). The authors estimate that on this basis the average near 2 per cent fall in house prices in Q1 2023 should reduce consumer spending by half a percentage point over two years. On that note, did I mention the latest GDP data in the UK…

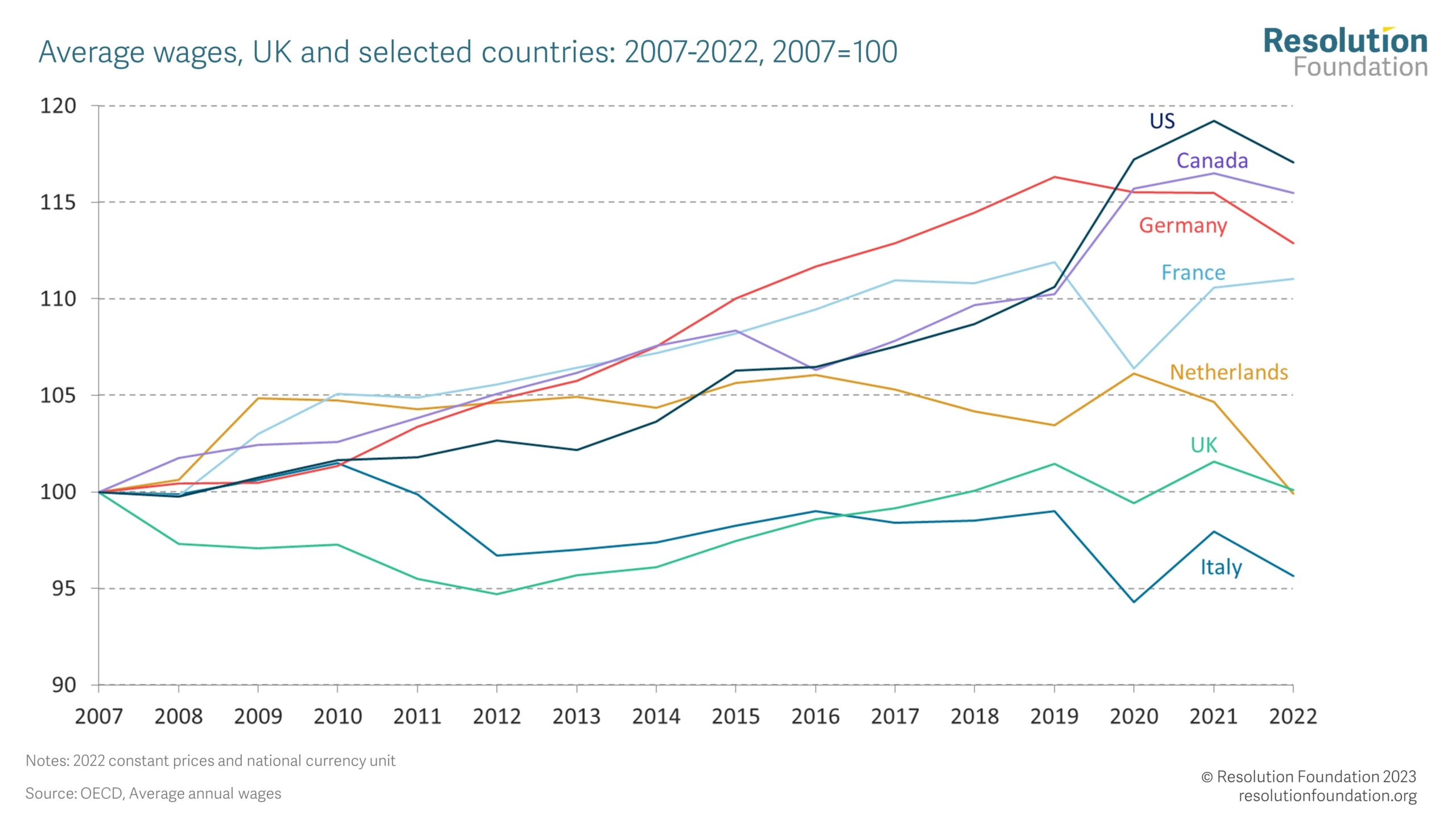

Chart of the week

After last week’s Ending Stagnation launch/TOTCs special a few people asked me how to reconcile some of the statistics in the book (e.g. productivity growth having been half the OECD average over the past 15 years) with those that government ministers tend to use in response (that the UK’s headline GDP growth since 2010 had been stronger than some competitors). This is worth explaining. GDP-wise the UK looks okay, thanks to a growing population (government ministers are less keen to mention the high migration cause). But it’s GDP per capita that really matters (especially for living standards) so that should be our focus. Here the UK does worse. In fact, ultimately it’s productivity and wages that really matter (employment can’t keep growing forever) so this week’s COTW confirms that the last 15 years haven’t been a triumph: only (basket case) Italy has performed worse than us, with the US, Canada, France and Germany surging ahead. I’ve included the Netherlands to make us feel a bit better – they’ve also had poor growth for parts of 2010s and found that being even more reliant on gas than Britain isn’t great for real wages during an energy crisis. And before the Dutch experience perks you up too much note that a) they’re still far richer (earning an average of over £7,000 more and b) they’ve just elected far-right loonies, so maybe flatlining wages isn’t what success looks like.