Fake news, phony data and falling debt

Afternoon all,

There are questions to which George Galloway – a painfully powerful speaker in our orator free era – is the answer. They just aren’t ones we should be asking – like how do we stoke divisions. The result last night is pretty staggering. The Labour, Tory and Lib Dem vote share in Rochdale totalled almost 90 per cent in 2019. Yesterday? It fell by more than two thirds, to 26.7 per cent. The parties – especially Labour – not the voters deserve the blame.

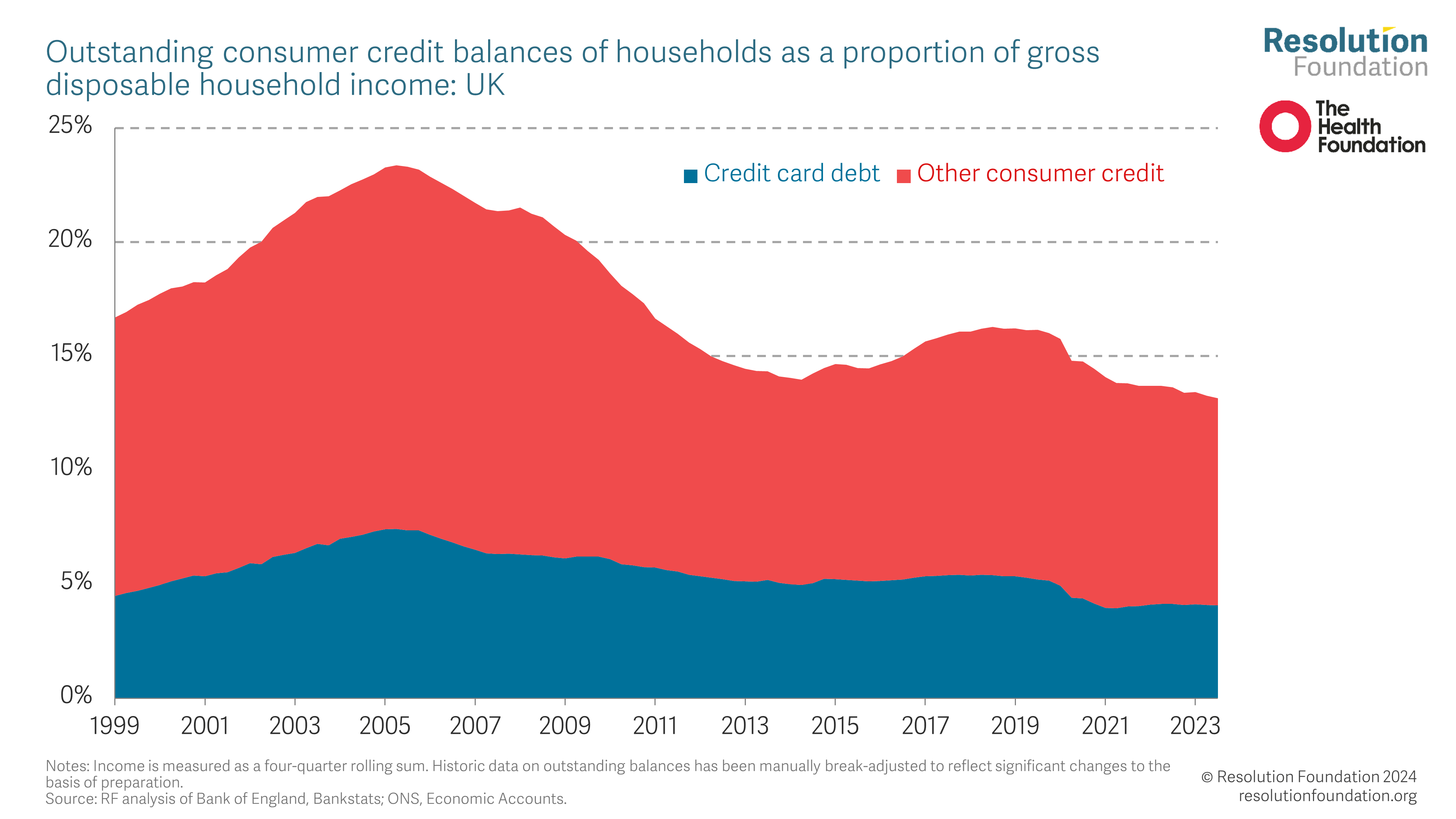

We all deserve some antidote to that gloom, so COTW brings you some economic good news. Over the past two decades – despite what you regularly hear – levels of consumer debt are way down. Now Britain just needs some other deficits addressing – like politics offering up some better-quality candidates for office. Maybe some of you lot should get on with standing. Chop chop.

Torsten

Chief Executive

Resolution Foundation

Fixing fake news. Academics love debating misinformation – it neatly fits the saviour complex which thinks that research/truth finding will sort out all the world’s problems without the messy politics. Supposedly reassuring research says that simple prompts on social media reduce our propensity to spread fake news. But how much do they reduce it? Showing Facebook users prone to sharing misinformation an advert encouraging them to consider the accuracy of content reduces the probability of them sharing misinformation by… 2.6 per cent – and that’s in the hour immediately after the ad. Showing similar Twitter users three similar ads a day for a week gets you a 3.7 to 6.3 per cent reduction. Not sure this has saved democracy.

Partisan patents. This is surprising. We’ve long known that investors and their animal spirits are affected by politics i.e. whether your side wins. But it appears the same applies to inventors. A new paper finds that Democrat leaning inventors were more likely to patent, compared to their Republican counterparts, after the 2008 Obama victory and less likely to after Trump’s victory in 2016. The effects are bigger for politically engaged inventors. With different fields of science increasingly segregated along political lines, this suggest elections could impact the direction not just the overall pace of progress. Great fact = “Republicans outnumber Democrats three-to-one in weapons patenting, but are outnumbered by Democrats five-to-one at Google.”

Dangerous driving. Don’t drive when you’re drunk hungry people. That’s the warning from a paper that, with Ramadan fast (ahem) approaching and intermittent fasting all the rage amongst the yuppies, caught my eye. The author examines what happens to accident rates during Ramadan in Turkey (where working hours don’t change so lots of hungry people are driving during rush hour). The author finds that it increases the chance of an accident by a staggering (almost unbelievably so…) 25 per cent – bigger than the impact of being sleep deprived. I don’t think this is meant as an argument against all of you fasting for health/religious reasons – maybe just a nudge not to drive too fast while you’re doing it.

Scholarly skirmish. I’ve held off including reads on the economics equivalent of the Battle for Midway currently raging in the States about quite how unequal the country is. This beef is between the disciples of Piketty (Emmanuel Saez and Gabriel Zucman) and David Splinter/Gerald Auten (economists in Congress’ Joint Committee on Taxation and the Treasury respectively). Piketty et al. vs Splinter et al. is a row, with never ending responses to each other’s latest arguments, about the best way to use imperfect data to come to a view on whether the share of income going to the very top has surged or broadly stayed flat since the late 1960s. A TOTC reader asked why we haven’t covered this. The answer is only the very keen are going to follow all the ins and outs, but have a read of this attempt at a precis of what’s going on, which rightly notes this isn’t a nice easy story about one major difference in approach, but rather a cluster of differing adjustments – “death by a thousand imputations”. And once you’re in this rabbit hole don’t forget: this isn’t a debate about whether inequality has risen, but by how much.

Correct counting. This is traumatic. A recent paper in Nature got loads of attention for suggesting that we are seeing less and less innovation in science over time. By examining citation networks among 45 million papers and 3.9 million patents, it argued that they showed levels of disruption falling. But some impressive data sleuthing has now revealed that the highly publicised result was driven by… database and software errors which involved papers incorrectly showing up in some analysis as having no references. The number of such papers declined over time – and that, rather than a decline in how disruptive science has become, drove the original paper’s results. What are databases? Dangerous.

Chart of the week

…as promised, brings good news. Consumer debt (think credit cards, personal loans etc, but not mortgages) is down. This is probably surprising given there’s regular news stories saying debt is rising, and households have obviously had a rocky few years with surging costs. This is important good news because high debt levels would be becoming even more problematic in today’s world of higher interest rates. COTW shows consumer debt has fallen by the equivalent of £48 billion compared to before the pandemic, around £1,700 per household. Lower debt levels mean that, despite the recent rise in rates, households are spending less on debt interest today than before the pandemic – saving them £1.8 billion a year. What’s going on? Lockdown-enforced saving saw debt decline, and we’ve seen providers tightening access to credit – recently and post-financial crisis. But I should add there’s also some less good news – debt hasn’t just shrunk, it’s shifted too. A growing number of households have instead been falling behind on priority bills like rent, utilities and council tax. Energy bill arrears are up by a half in a little over a year. Bill arrears don’t involve the same interest costs – but can become very serious, from getting your energy cut off to being served an eviction notice. This is the new face of household debt for all of us to focus on.