The Mortgage Crunch

Recent signs that inflation is proving ‘stickier’ than hoped has raised the prospect of even more rate rises from Bank of England, and a deeper mortgage crunch for households.

Higher than expected inflation and earnings in April has led financial-markets expectations of the peak to the current interest rate rise cycle to rise to nearly 6 per cent – close to levels seen after the fallout from ‘Trussonomics’ last autumn.

This is swiftly translating into higher mortgage rates: annual repayments are now on track to be £15.8 billion a year higher by 2026 compared to when the Bank started raising rates in December 2021, up from £12 billion as recently as May. Annual repayments for those re-mortgaging next year are set to rise by £2,900 on average – up from £2,000.

The bad news for the Government is that three-fifths of the mortgage pain is still to come – with almost £5 billion set to hit in 2024 when an election is likely. The better news for the Government, however, is that while the current mortgage crunch is big, it is more concentrated than Britain has seen in recent decades. Back in 1989, almost 40 per cent of households owned a home with a mortgage and were therefore exposed to rising costs. By last year, the combination of more older people owning outright, and fewer young people owning at all, meant that the share of households with a mortgage had fallen below 30 per cent.

The latest moves in market interest rates suggest that a dire outlook for UK mortgagors just got worse. If rates move in line with expectations, UK families are set to face a prolonged and historic mortgage crunch. All households can do is hope that market expectations prove wrong amidst high uncertainty about the extent of rate rises that will be needed.[i]

Recent data suggests inflation is likely to prove ‘stickier’ than hoped, raising expectations for how high the Bank of England is likely to raise rates

Inflation isn’t going away as quickly as hoped – which is bad news for the Bank of England. Inflation data for April came in stronger than expected at 8.7 per cent (the Bank was expecting 8.4 per cent). And this week’s data on pay reinforced perceptions that inflation was proving stubborn with annual regular pay growth in April coming in at 7.5 per cent – the highest on record outside of the pandemic (when the data was affected by changing labour-market composition).

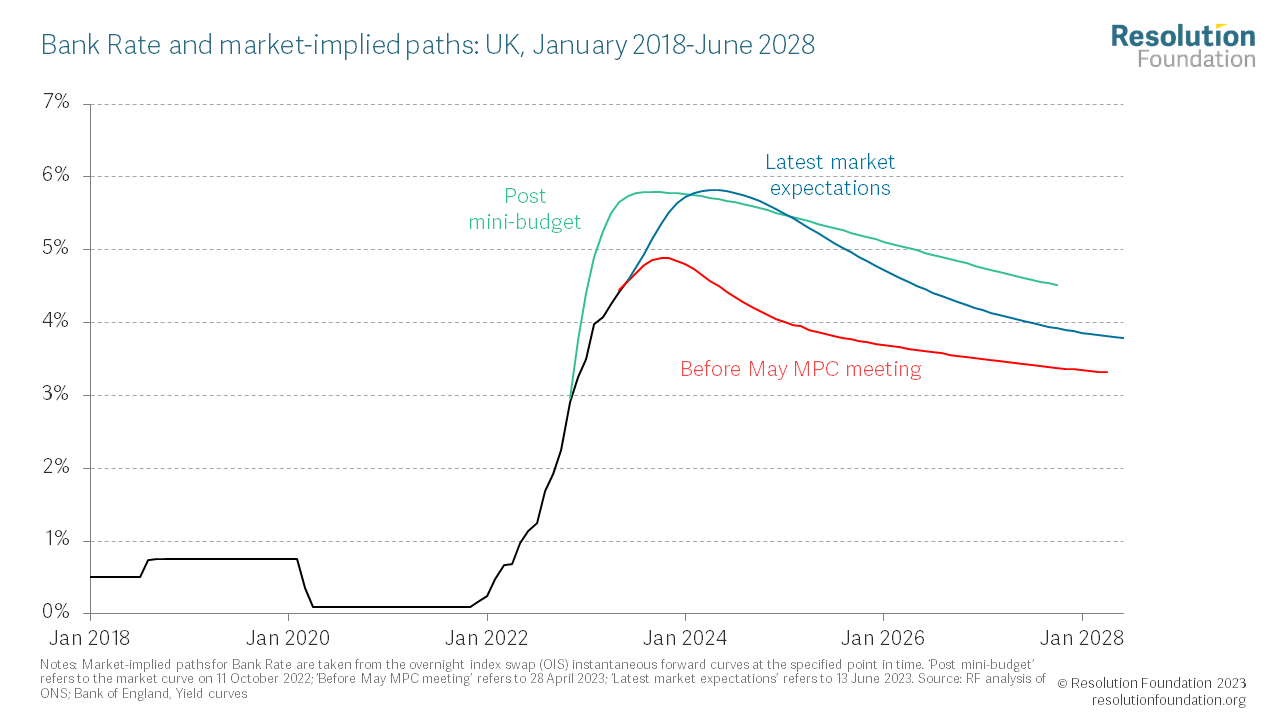

The recent news on inflation’s persistence has raised expectations of the Bank of England needing to raise rates higher and for longer. Bank Rate is now expected to peak at nearly 6 per cent in mid-2024, up from a peak of less than 5 per cent on the eve of the Bank’s last rate-setting meeting (Figure 1).[ii] Such a high peak for Bank Rate expectations hasn’t been seen since the mini-budget sent rates skyrocketing last autumn.

Figure 1: Financial markets now expect Bank Rate to peak at nearly 6 per cent, up from less than 5 per cent just over six weeks ago.

Mortgage rates have already started to go up and could stay high for years to come

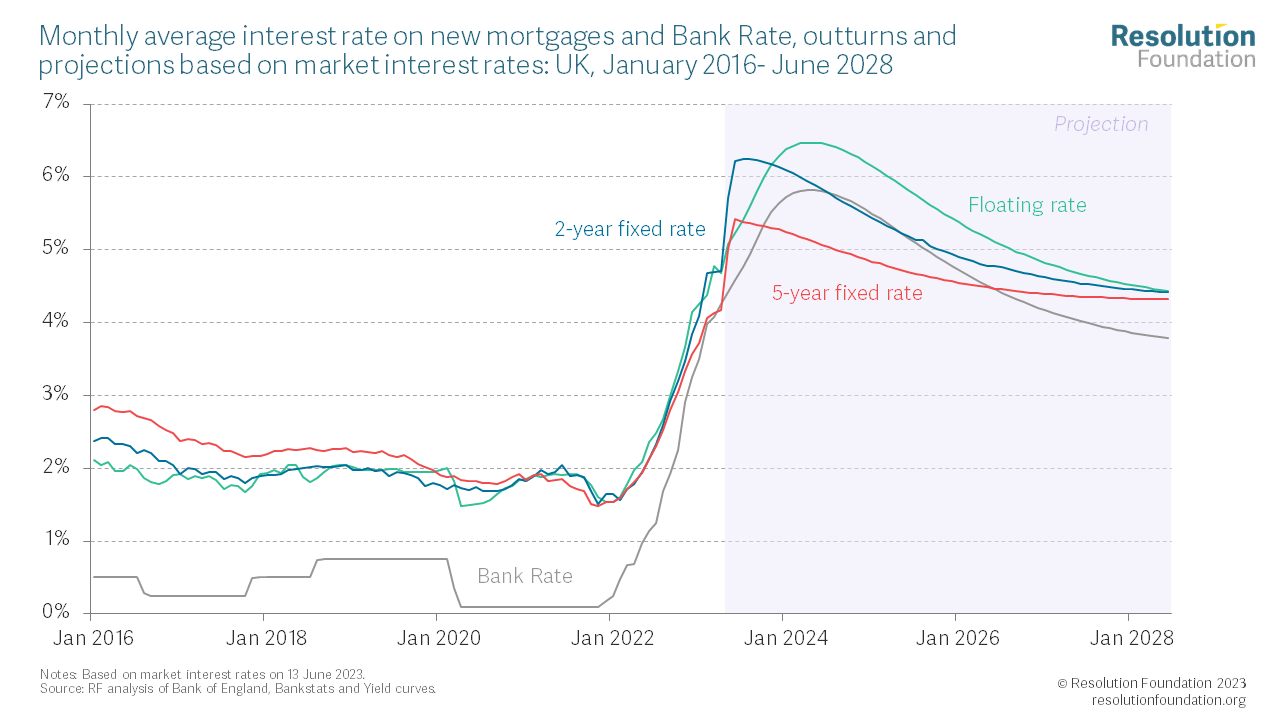

And higher rates are even worse news for anyone looking to remortgage soon. Mortgage rates have already begun to rise, as higher expectations for Bank Rate feed through to banks’ funding costs today. This has come with hundreds of mortgage products being withdrawn from the market and replaced with new higher rate deals. And families in the UK shouldn’t expect to see a quick reversal in rates any time soon. Based on the latest market expectations for Bank Rate, we estimate that the average rate on a two-year fixed-rate mortgage is likely to reach 6.25 per cent this year based on current market pricing and won’t fall back below 4.5 per cent until the end of 2027 (Figure 2).

Figure 2: Interest rates are set to remain at levels not seen for more than a decade

The rise in interest rates means that British families could now face nearly a £16 billion increase in their annual mortgage bill, up from £12 billion just six weeks ago

The impact of higher mortgage rates will take time to be felt fully. Based on previous Resolution Foundation analysis, we estimate that, by the end of June, 4.2 million households in Britain will have seen their mortgage rate change since the Bank of England started raising rates in December 2021. This is around half of all mortgaged households (56 per cent), with the remaining 3.3 million households (44 per cent) yet to see their fixed-rate deal expire.

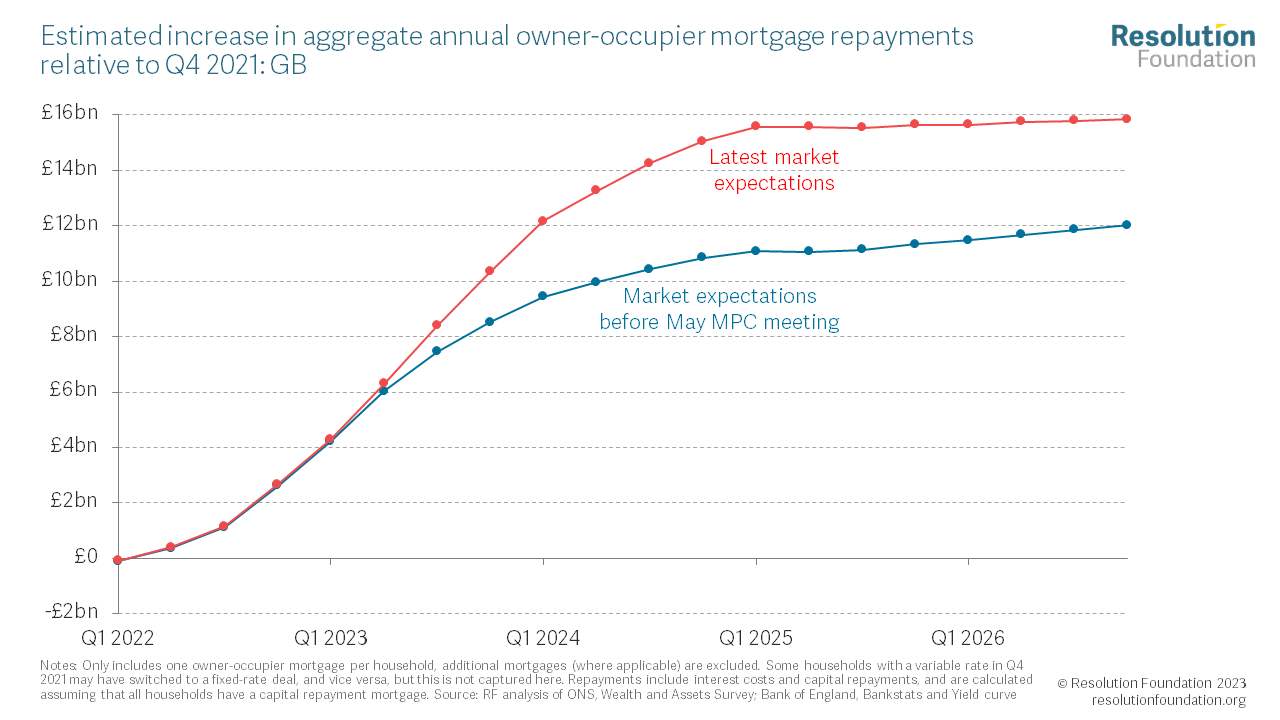

Based on recent moves in interest rates, the outlook for British mortgagors is much worse than it was just weeks ago. Based on current market expectations, we estimate that total annual repayments could increase by £15.8 billion by the end of 2026 compared to where they were in December 2021, compared to an estimated £12 billion increase based on market expectations for interest rates at the end of April – a rise of nearly a third (Figure 3). By the end of 2026, almost all British households with a mortgage (7.5 million) will have moved on to a higher rate, and are set to end up with annual mortgage bills that are £2,000 higher on average compared to December 2021.

Figure 3: Aggregate mortgage repayments are projected to rise by £15.8 billion, with nearly three-fifths of the rise still to come

The bad news for the Government is that much of Britain’s mortgage pain is still to come

Many UK families have already seen a significant increase in their mortgage costs as rates have risen. We estimate that aggregate annual mortgage repayments will have increased by £6.3 billion for UK households between December 2021 and June 2023 – an average increase of £1,500 for the 4.2 million households who will have seen their rate change.

But, that means that three-fifths (£9.5 billion) of the projected total increase in repayments is still to come, and £4.7 billion of this increase is due to fall in 2024. This is bad news for the Government with a 2024 election looking likely.

With Bank Rate now expected to reach its peak in 2024, next year could be a particularly painful one for British mortgagors. Based on current market expectations, households whose fixed-rate deal expires in 2024 will face an average increase in repayments of £2,900 – compared to £2,000 if rates followed the outlook from the end of April. And households who opt for a floating-rate loan, where the rate they pay is directly linked to Bank Rate, will also face significantly higher repayments. By the end of 2024, 95 per cent (£15.0 billion) of the total projected increase in repayments up to the end of 2026 will have come through.

But the good news for the Government is that today’s mortgage crunch will be less widespread than that of the early 1990s

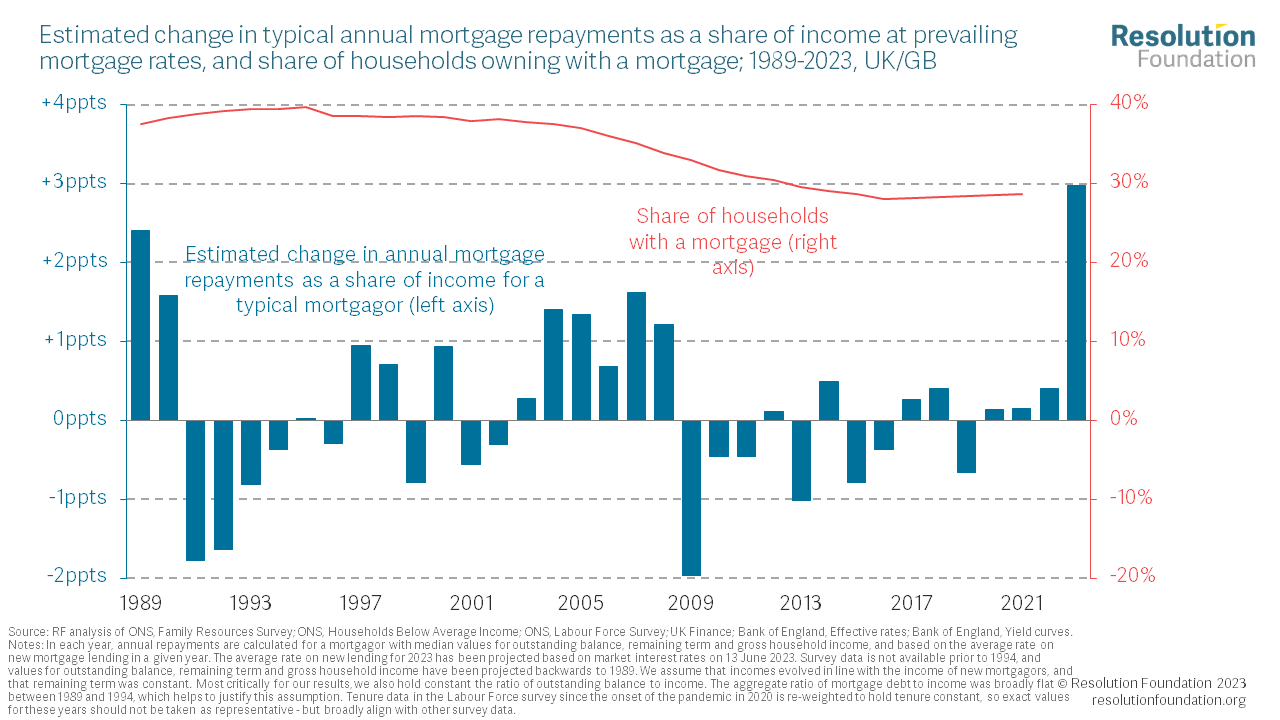

The speed of rate rises today means that – for the households that have a mortgage – the income hit from higher rates this year is worse than anything seen in previous decades. Although Bank Rate isn’t expected to reach the highs of the late 1980s and early 1990s, mortgaged households today are more leveraged than their historic counterparts. That means that, for a typical mortgagor, the rise in rates in 2023 alone is expected to increase repayments by 3 per cent of household income – or around £2,000. This is a bigger annual hit than at any time in almost five decades. When repayments surged in 1989, as the Bank of England raised rates to nearly 15 per cent, the increase in repayments was only about £1,200 in today’s money for the typical mortgagor, or 2.4 per cent of household income.[iii]

But the pain of higher repayments is set to be much less widespread than in the past. Back in 1989, almost 40 per cent of households owned a home with a mortgage, and so were exposed to rising costs. By last year, the combination of more older people owning outright, and fewer young people owning at all, meant that the share of households with a mortgage had fallen below 30 per cent (Figure 4). This is good news for the Government as it means that the mortgage pain is more concentrated among the electorate.

Figure 4: Today’s mortgage crunch is acute, but will affect fewer households than previous rate-rising episodes

The latest moves in market interest rates suggest that a dire outlook for UK mortgagors just got worse. If rates move in line with expectations, UK families are set to face a prolonged and historic mortgage crunch. But market expectations can be wrong, and recent experience has taught us just how much uncertainty there is around where rates will go in the future. Millions of mortgagors across the UK will be hoping that rate rises don’t turn out to be as bad as currently feared.