One statement, two challenges

It’s been brought forward, delayed and renamed, but the Autumn Statement is finally happening this week. While the timing has been uncertain, from the coverage of recent weeks you’d think its purpose was a very clear story of two Prime Ministers: Liz Truss created a fiscal black hole and Rishi Sunak is now filling it in.

But this isn’t a good way of thinking about what’s happened or is coming. Instead it’s more useful to think about the Autumn Statement as a tale of two economic policy challenges, shaped but far from created by Liz Truss’ brief tenure in Downing Street. The two the Chancellor is answering on Thursday are highly related, but for different reasons stand out for their inherent tensions that cannot be fully resolved. The test is whether they are well or badly managed. Indeed, they provide good case studies of what can make Chancellors – often considered omnipotent in Whitehall – lives difficult: external constraints and a highly limited set of policy levers.

First, the Chancellor is aiming to turn his rhetoric, about making the UK’s (smaller-than-hoped-for) economy fiscally sustainable, into reality. He wants to do that without further shrinking that economy. This is hard. Tax rises and spending cuts announced for the second half of this decade are about as credible as my daughter’s nightly promise to tidy her bedroom tomorrow, while those introduced imminently will be unwelcome bedfellows with a recession.

Second, the Chancellor has to set out how to help households pay the high energy prices that are the main cause of the recession that we are already slipping into. His task is to support two overlapping groups that are worst affected: those with the largest bill increases (often because of hard-to-heat homes) and those on lower incomes who are least able to cope with those bill rises. As things stand there is no policy lever that achieves both.

This spotlight considers each challenge in turn, how they are likely to be answered this week and why.

Liz Truss didn’t create a fiscal hole, she just dug it deeper and shone a huge light on it

Rishi Sunak and the Labour Party have good, if slightly different, reasons for emphasising Liz Truss’ responsibility for the grim fiscal forecast the Office for Budget Responsibility (OBR) will publish alongside the Autumn Statement. And she certainly deserves a good share of it, permanently increasing borrowing by up to £30 billion.

Spending the summer saying that fiscal orthodoxy and Bank of England independence needed blowing up will cost us up to £10 billion by the middle of the decade in higher borrowing costs relative to other advanced economies. This represents an upper bound to the impact of the remaining ‘moron premium’ even after the amount the UK is charged to borrow compared to other advanced European economies has returned to its pre-mini-budget levels. Meanwhile the remnants of the tax cuts extravaganza have added over £18 billion in the medium term, principally from scrapping the National Insurance increase (Jeremy Hunt’s subsequent scrapping of the 1p reduction in the basic rate pushes in the opposite direction to the tune of around £6 billion).

But with the total medium-term fiscal deterioration looking more like £85 billion (compared to the OBR’s previous forecast in March) it’s clear only a minority has Liz Truss’ name on it. Indeed, the best way to think about her legacy isn’t the existence of a fiscal hole, but the urgent focus on it. The price of calling into question the UK government’s commitment to fiscal sustainability is the UK now debating tax rises/spending cuts, while other advanced European economies aren’t. The UK has around the same debt levels as the euro area but while EU institutions are discussing new fiscal rules and warning about deteriorating public finances, EU governments only face medium-term pressure to do anything.

It’s higher rates and lower growth doing the big, but very uncertain, damage

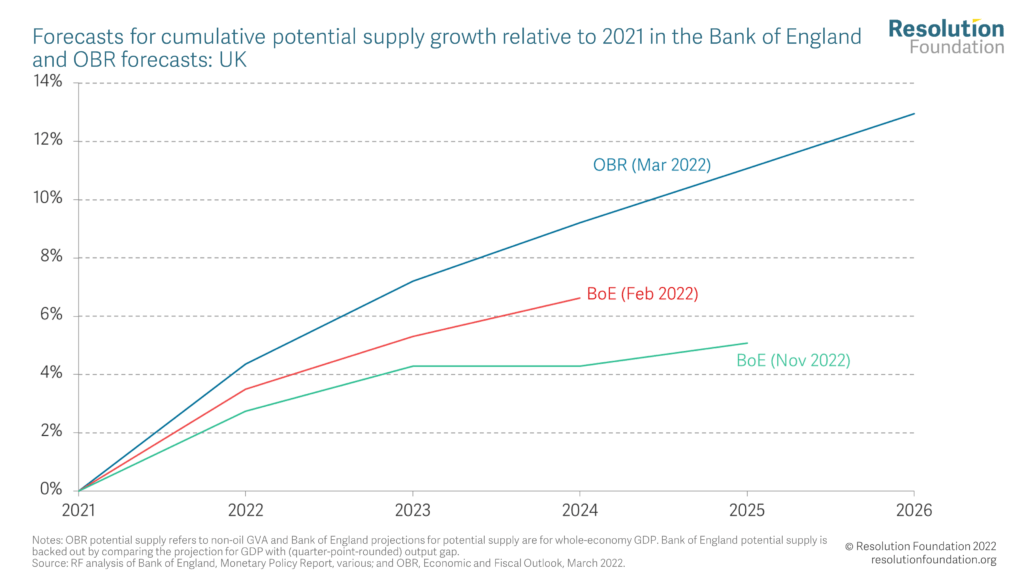

If Liz Truss only cost the Treasury around £30 billion, why is the Chancellor warning about ‘tough decisions’ totalling over £50 billion? You’ll have heard (or felt, if only emotionally, in the case of mortgagers) about interest rates rising round the world, raising the cost of government debt. But lower growth, not just higher interest rates, is doing a lot of the permanent damage. Figure 1 shows cumulative growth in potential GDP from 2022 as forecast by the OBR in March and the Bank of England in February and November. It tells you two things: the OBR was much more (too?) optimistic than the Bank in early 2022, and the Bank has got a whole lot more pessimistic since.

Figure 1: The Bank of England has become pessimistic about longer-term growth

To get a sense of how much this matters for the public finances here’s a thought experiment. If the OBR revise down their projections for the sustainable size of the UK economy by as much as the Bank has done it would take 2.25 per cent off GDP by end of 2024 – very roughly hitting tax revenues by £25 billion. If the OBR get as pessimistic as the Bank, with almost no supply growth in the next few years (which does seem genuinely pessimistic), you can make those numbers around 4.5 per cent and £50 billion respectively.

The scale of these numbers spells out how crucial some growth is (that’s the bit Liz Truss got right). But the variation in them also highlights a key feature of the fiscal deterioration: it’s hugely uncertain scale. This in turn interacts with the government’s chosen fiscal rules to drive estimates of the, equally uncertain, ‘fiscal hole’. Some argue this uncertainty is a reason for ignoring the deterioration entirely, which would be a bold response given the experience of the last two months. But that uncertainty, as well as weak outlook for the economy and longer-term pressures on public services, should shape the policy response.

The Autumn Statement won’t really ‘fill the fiscal hole’, but make a down-payment on doing so

On Thursday the Chancellor will talk as if the goal of the Autumn Statement is filling in the “fiscal hole”, but its real job is something else: making UK economic policy look normal again without deepening the recession we’re entering. There is an unavoidable tension here, with more immediate tax rises or spending cuts being both more ‘credible’ (i.e. the markets are more likely to believe they are real) and riskier (given an already slowing economy).

Navigating this tension, and the political reality that people don’t mind talk of tough choices but don’t support their reality, means the Autumn Statement is likely to make a down-payment on improving the public finances with some tax rises, while leaving the bulk of the fiscal tightening to another day.

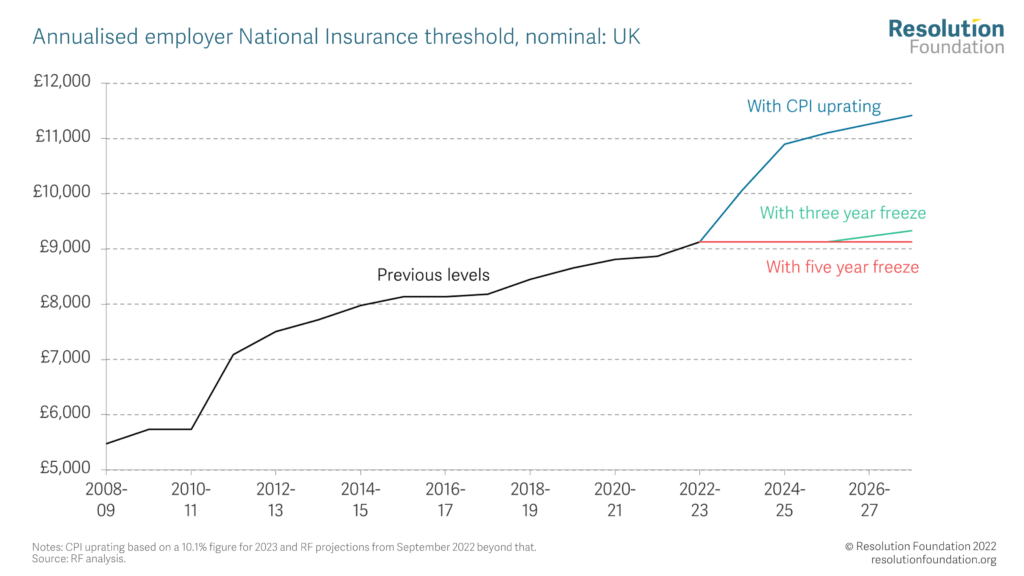

On the former, some may ask whether there are any easy tax rises left for the Chancellor to provide that down-payment, with his predecessor (and now boss) having picked the low-hanging fruit this time last year (via corporation tax rises and tax threshold freezes). The answer is yes: there is one lone, but large, part of the tax system that isn’t yet frozen and could be to raise significant sums without the public noticing: the employer National Insurance threshold, as shown in Figure 2.

Figure 2: Freezing the starting point for employer National Insurance would be a major tax rise compared to uprating in line with inflation

Current high inflation means that if this is frozen at its current level for the next three years it would raise up to £7 billion, and the Government would argue that this in aggregate is almost equivalent to reinstating the employer half of the now scrapped National Insurance rates hikes. If you’re all about raising revenues via fiscal drag, this is where you’d find them, probably in combination with tax rises on energy-related windfalls and potentially higher earners/those receiving capital gains.

Deferred fiscal tightening meanwhile will come on both the tax and spending side, with 1 to 2 per cent day to day public service spending growth pencilled in for the years after 2025 (saving around £25 billion) and extending freezes on basically every threshold in our tax system into 2026 and 2027 (raising around £6 billion if you include employer NI). This is how the Treasury makes the fiscal arithmetic add up spreadsheet-wise, rather than a serious plan for balancing the books. In particular, such tight spending control won’t happen in practice (it would involve taking many public services’ back to peak austerity of 2018-19). Some believe that is a big problem for market assessments of the Autumn Statement’s credibility. Personally, I’d see it more as a political challenge (defending spending cuts you can’t implement) rather than a markets problem. If you’re announcing tax rises rather than cuts today, and promising to balance the books rather than blow up fiscal orthodoxy tomorrow, you’ve already come a long way from the fiscal vibes of the mini-budget.

Energy bill support will be centre stage on Thursday as the Truss and Sunak approaches merge

The advance briefing of the Autumn Statement has focused on the fiscal arithmetic and tough choices to come, partly to set our expectations. But it’s also to increase the chances of news coverage on the day focusing on the answer to the second challenge facing the Chancellor: what support to give households facing high energy bills next year is the giveaway part of the Autumn Statement.

Currently the typical household has an annual bill of £2,100 (the £2,500 Energy Price Guarantee minus £400 support payments). However once these protections expire in April, said family could see bills double to £4,000 – a simply unsustainable sum for millions.

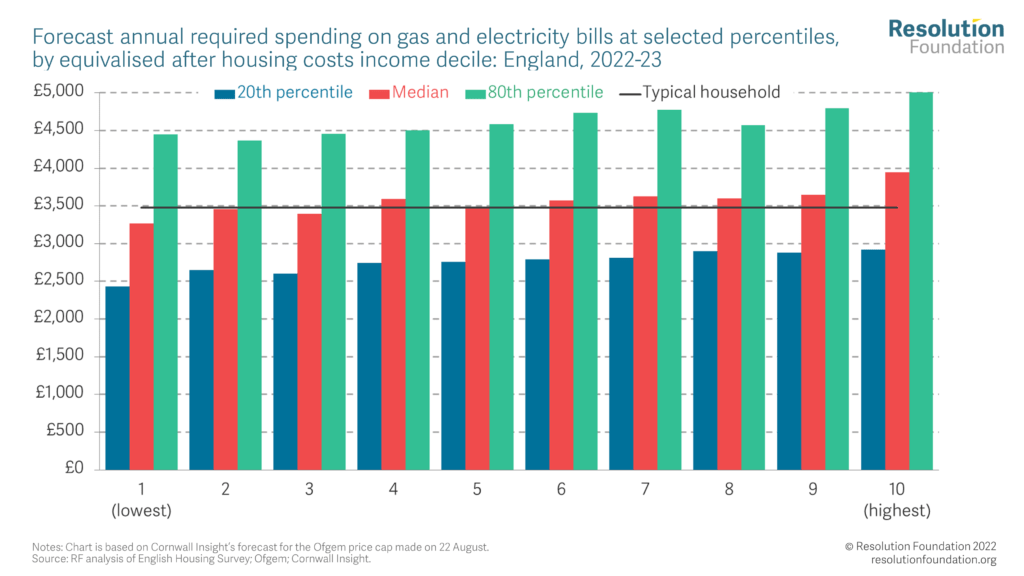

Getting the next support policy right is far from easy, because support would ideally respond to the dual variation in the size of energy bill rises (where those who consume the most energy are most vulnerable) and households’ ability to cope with them (where those on lower incomes are).

The challenges of achieving both these objectives have underpinned multiple changes in government support packages over the past year. That process tells us what the Treasury is likely to announce this week. Liz Truss thought Rishi Sunak’s focus on direct payment to vulnerable households was flawed, leaving too many low-and-middle income households out. Their lump sum nature also couldn’t recognise the variation in energy use among lower income households, which is much bigger than that between richer and poorer households, as Figure 3 illustrates.

Figure 3: Wide variation in energy usage across the income distribution means households will face a range of additional energy bill costs this year

Jeremy Hunt in turn rejected Liz Truss’ approach of relying on a cap on energy prices (the Energy Price Guarantee) as the main policy response, on the grounds that it might have better matched support to the size of energy bills but was poorly targeted at those on lower incomes, and incredibly expensive as a result.

You can see the circularity of the policy development process here as we swing from targeting household incomes, to targeting bill increases, and then rejecting that in turn. The only way to overcome this challenge is to create a new policy lever that jointly targets bill size and household income – a means-tested social tariff.

But the Treasury has decided that it’s too hard, so they only have one choice left: to combine the Sunak and Truss policy levers and target the two problems separately. Expect a repeat of Sunak’s lump sum payments to vulnerable households and the Energy Price Guarantee kept, but at a higher level to insure households against particularly high energy costs, rather than scrapped as Jeremy Hunt initially announced.

Keeping both policy levers will leave the Chancellor in an uncomfortable position of having an expensive package (this will cost tens of billions next year) that still leaves some people feeling very hard done by: capping bills at £3,100 (as trailed in The Times this morning) would be an effective £1,000 jump on where we are now.

This approach would see many poorer households receive significant help, and support next year would be more progressive (although lower) than that provided this winter. Repeating fixed payments to Universal Credit (UC) claimants, disability benefit recipients and pensioners would cost in the region of £9 billion if they are the same size as before. But given the jump in bills expected, larger targeted payments would be needed to provide the same protection. Bigger bills and bigger support payments mean the cliff edge between those on benefits (who get support) and someone earning £1 too much to qualify would be a very big deal indeed (something highlighted by a recent evaluation of the first round of lump sum payments). Remember four-in-ten of the poorest households do not receive means-tested benefits.

The Autumn Statement will wrestle with but not resolve two of the big policy challenges facing Britain

While policy discussions often proceed under the premise that permanently solving a particular challenge is in reach, more often than not managing well rather than resolving is what plausible success looks like. That will certainly be true this week. The lasting implications of the UK having a smaller economy than we all hoped for our public finances will be recognised, but far from fully addressed (not least given our currently shrinking economy and huge uncertainties involved). Meanwhile our attempts to wrestle with the impact on households of high energy bills will continue to be hampered by limited policy levers and will leave many households facing a very difficult 2023 indeed. The uncomfortable reality is that unless global energy price rises reverse we will remain poorer as a country than we’d hoped to be. The world is as it is, not as we would like it to be, but the question is how well we wrestle with that reality.